Once again, we are coming to the end of the financial year and so much has happened in the last year it’s hard to believe!

This year we want to remind you of all the tools GovReports has to help you streamline your end of financial year processes. Make the most of the inbuilt tools to maximise productivity and minimise stress.

Activity Statement Summary

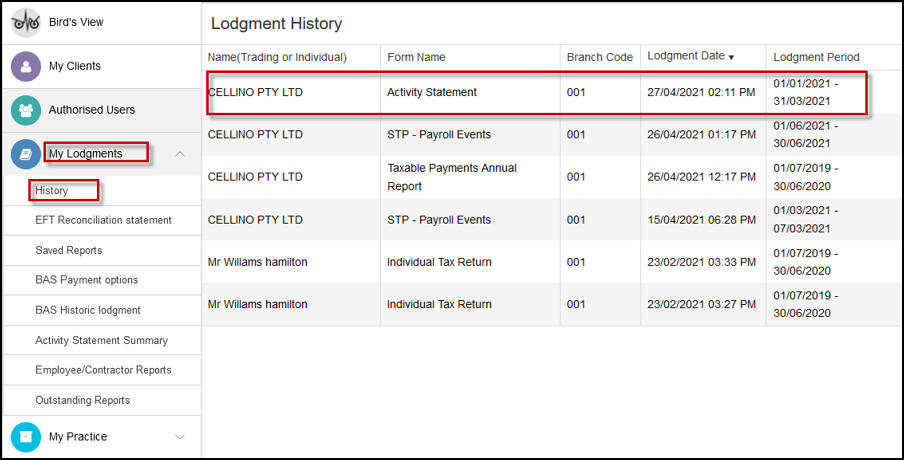

Have you tried the new Activity Statement Summary report yet? This report gives you a summary of all activity statement lodgments with the ATO for each financial year since the start of GST.

Even if clients have lodged reports with different registered agents over the years, you can easily see all lodgments, regardless of how the statements were originally lodged.

Check the My Lodgments menu for access to this report. This report is great when you take on a new client and want to get a history of lodgments. The report shows GST, PAYGI, PAYGW, FBT, FTC and WET amounts as lodged with the ATO and the total amount payable.

The Activity Statement Summary is also indispensable for end of financial year reconciliations! Before you lodge the June BAS, you can check this report for all amounts that have been lodged with the ATO and reconcile it to your client’s accounting software current reporting to pick up any adjustments that may be needed. Simply run the report for each client’s 2021 lodgments and save it to Excel.

End of year reconciliations made super easy!

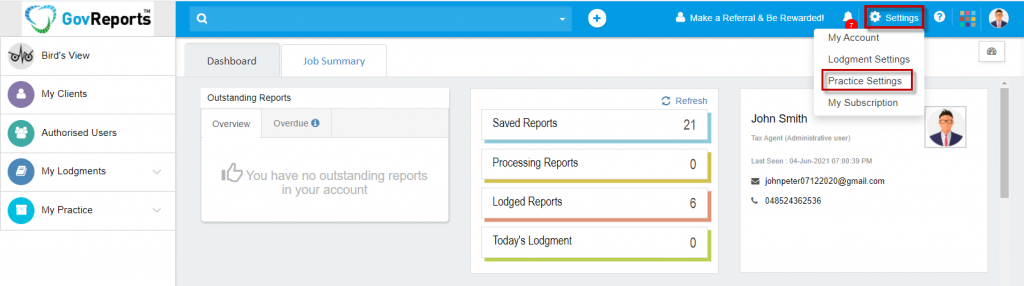

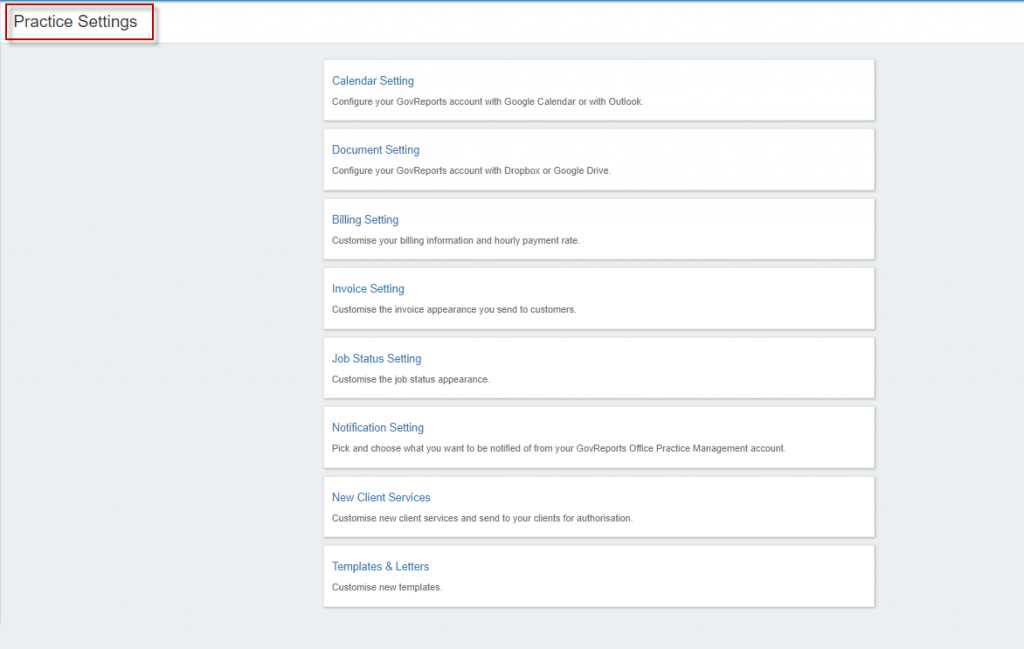

Office Practice Manager

Earlier in the year, we updated our user guide for Office Practice Manager. If you need a refresher about setting up OPM the way it will work best for you, check out the improved user guide. Or, if you’ve been putting off setting up OPM, take some time when it’s a little quieter in June (if you’re lucky) to get to know the practice management tools and get set up ahead of the new financial year.

You will see instructions and screenshots to help you get everything in place, from jobs, tasks and checklists, to calendar integrations to time tracking and billing.

Remember that OPM allows you to set up letters and templates for efficient client communications, from informative emails to client proposals and letters of engagement.

If you’re managing a remote team, then GovReports OPM facilitates collaboration with team members, enabling you to track the status of jobs, schedule tasks, set priorities and get real-time visibility of all job statuses.

Why pay for other practice management tools when GovReports gives you all you need in the same subscription?

Digital Authentication

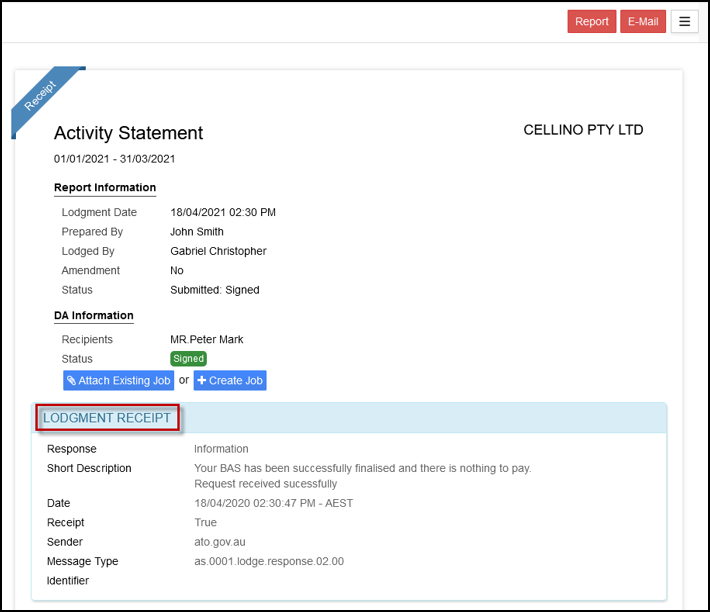

Your GovReports subscription includes access to digital authentication. There’s no reason not to use it for every signature you need! Make it easy for your clients to sign authorisations prior to lodgement.

GovReports Digital Authentication offers the best security and only takes seconds. Your clients receive a security code to their email to use in the document to be signed. In addition, you receive automatic notifications when the document is signed.

This inbuilt function is an enormous time-saver for your business, as you no longer have to deal with individually sending and filing signed documents. You will always have an audit trail showing the activity log from when the document is sent to when it is opened and then signed.

ATO Integration

Remember, you can access the ATO Integrated Client Account from GovReports. Use this report in conjunction with the Activity Statement Summary to reconcile lodgements and payments.

You can also update client details and authorisations from within GovReports, eliminating the need to log in separately to the ATO.

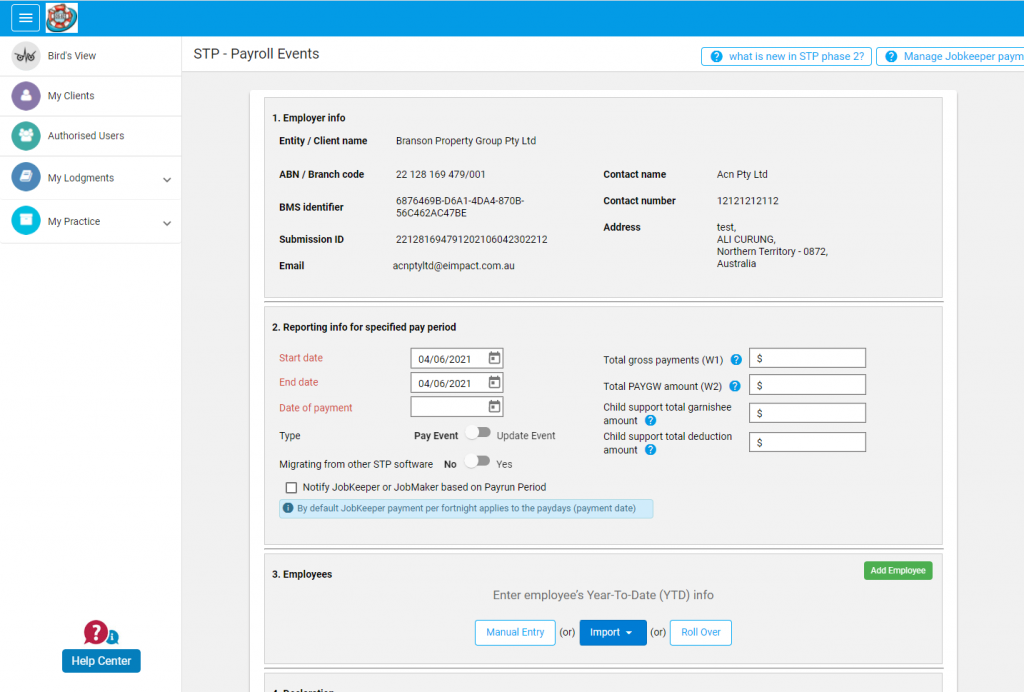

Single Touch Payroll Finalisation

Single Touch Payroll finalisation must be completed by Wednesday, 14 July 2021.

Once the STP finalisation has been sent to the ATO, the employee’s information will be released in their myGov account and listed as ‘tax ready.

Note that the STP finalisation process also replaces the Payment Summary Annual Report (PSAR). This data is included in the finalisation process submitted to the ATO.

Single Touch Payroll Phase 2

STP Phase 2 reporting is ready! GovReports has enabled the detailed payroll information reporting capacity well ahead of schedule.

Phase 2 includes many upgrades to STP reporting:

- Allows reporting to multiple government agencies

- Includes more categories

- Automatically files new employee tax file numbers with the ATO

- Includes reason for termination – no need for an employment separation certificate

- Clearer employment termination payments, salary sacrifice and lump sum payments reporting

- Child support payment information sent automatically to the child support registrar – no need for separate reporting

STP Phase 2 is easier to use overall, so go ahead and activate Phase 2 in your GovReports account. Once you do this, there’s no going back to STP V1, but we don’t think you’ll want to.

PAYG Payment Summary Annual Report (PSAR)

For any payments made to employees or contractors that have not been reported via STP, payment summaries still need to be issued by 14 July, and the payment summary annual report must be submitted to the ATO by 14 August.

You can manually enter details or import an EMPDUPE file from your software to lodge the PSAR with the ATO from GovReports. You may need to report payments such as those for closely held payees, contractors with a voluntary withholding agreement, contractors for whom no ABN withholding applies or royalties.

GovReports Blog and Webinars

You can check our blog and webinars for detailed information about all of the topics in this article. And don’t forget the Help Centre for user guides on all aspects of setting up and using GovReports.

We wish you an efficient and stress-free end of financial year!

GovReports Team