GovReports Taxable Payments Annual Report (TPAR) online lodgement form service has 3 options:

- Fill in contractors details with online forms.

- Upload software generated TPAR back up file.

- Upload TPAR in CSV file format. “Sample file” available within GovReports.

The following steps shows you how to fill contractors details on TPAR form and lodge direct to ATO.

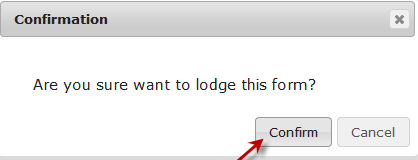

Step 1: Select Business name from My Business

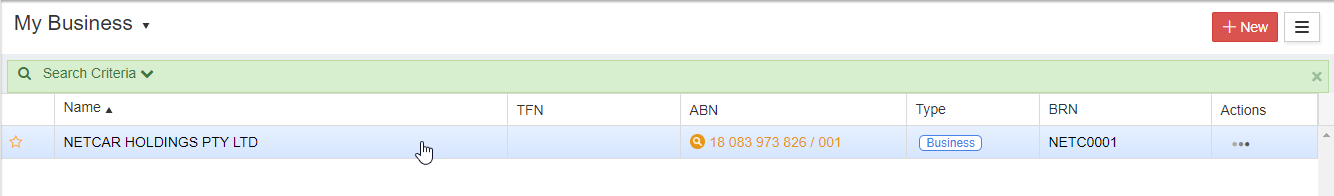

Step 2: Select Forms for the particular Client and select Taxable Payments Annual Report.

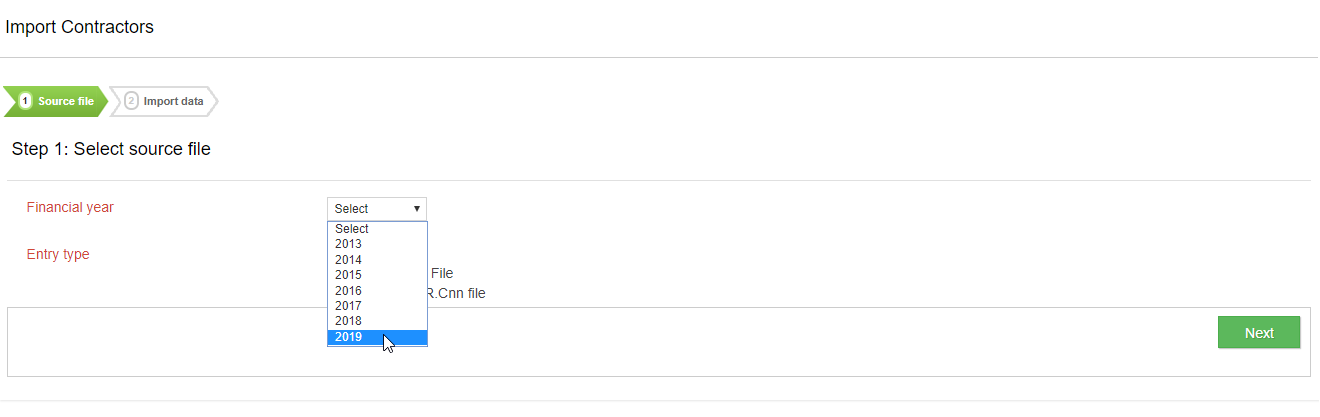

Step 3: Select the financial year in the list.

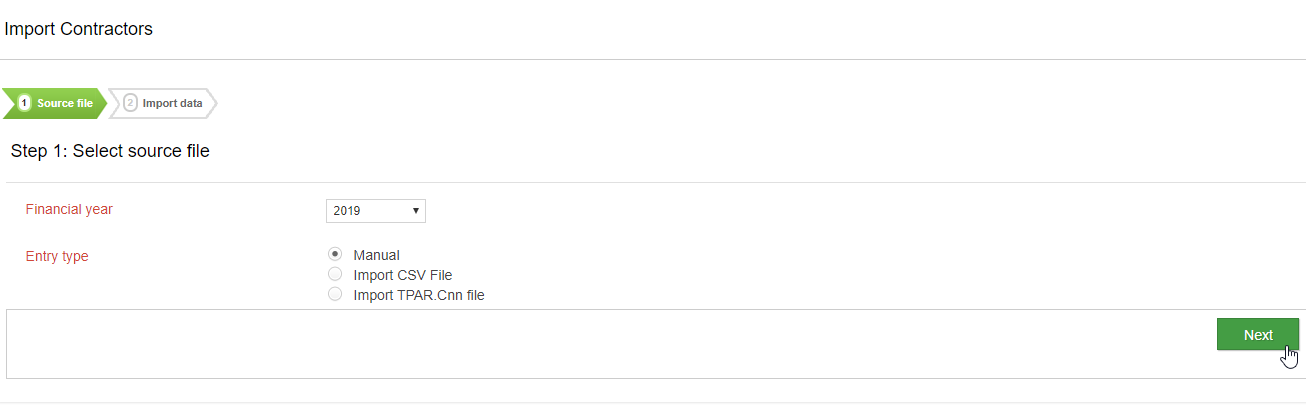

Step 4: Select the Entry type as ‘Manual’ and click Next.

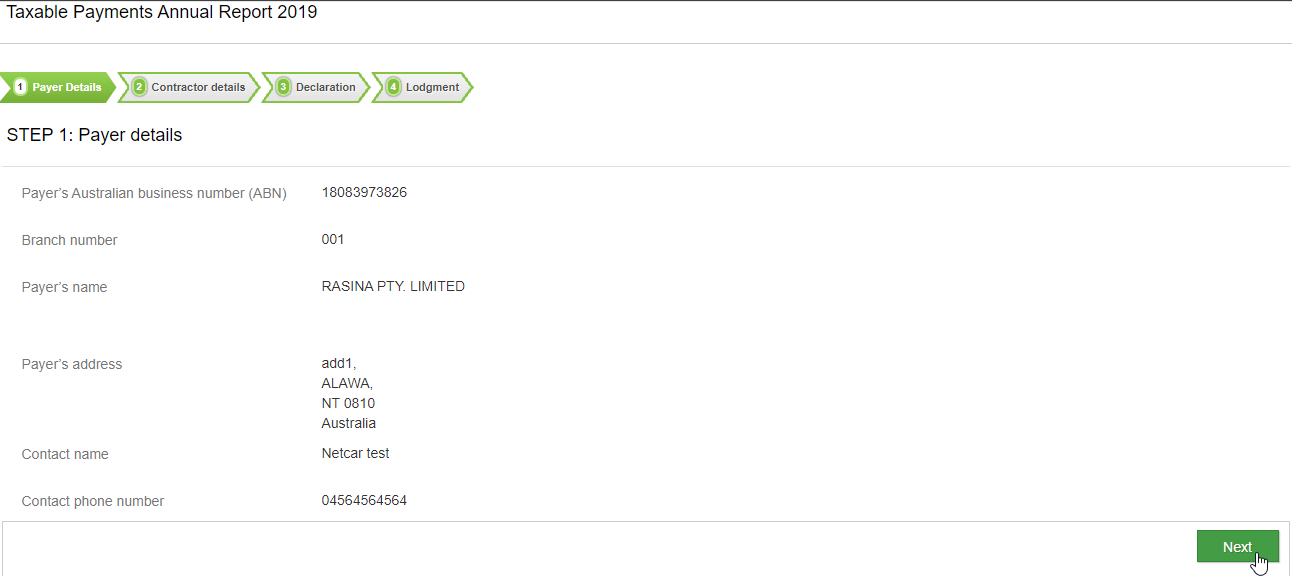

Step 5: Click Next.

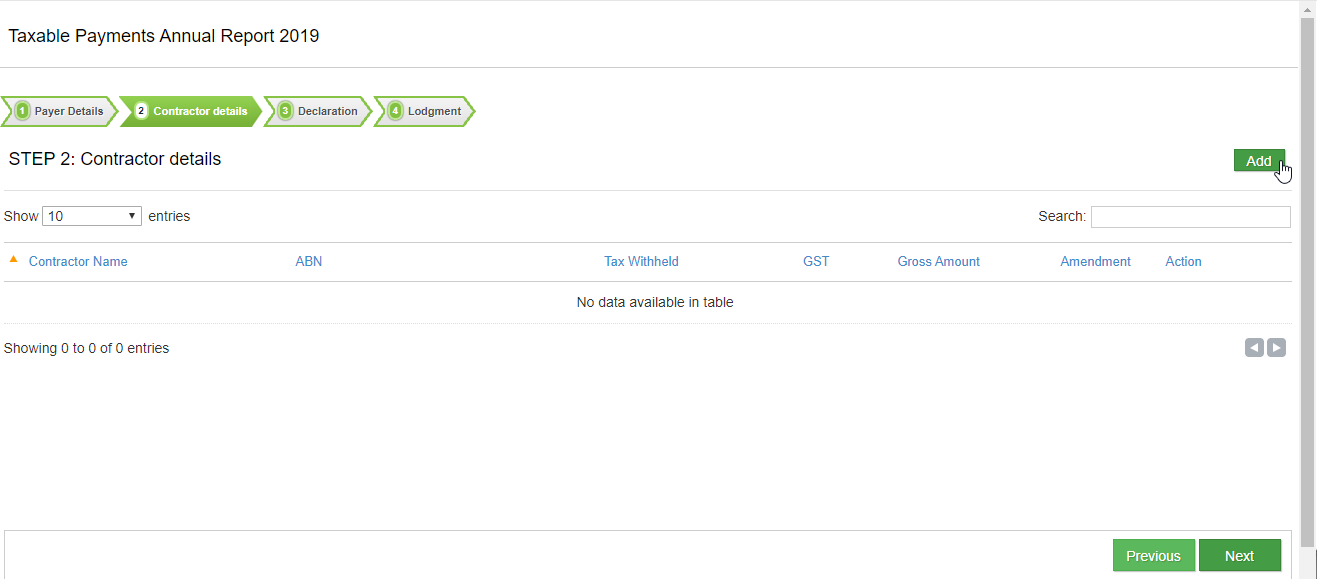

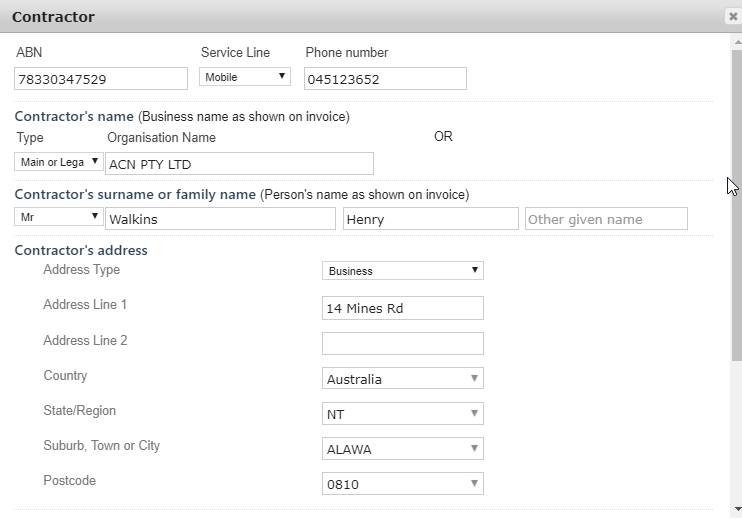

Step 6: Click Add to add contractor details.

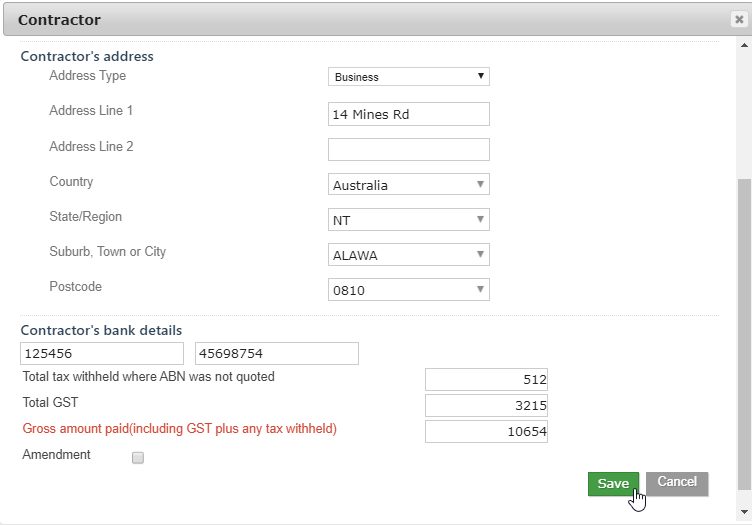

Step 7: Fill the details and click Save.

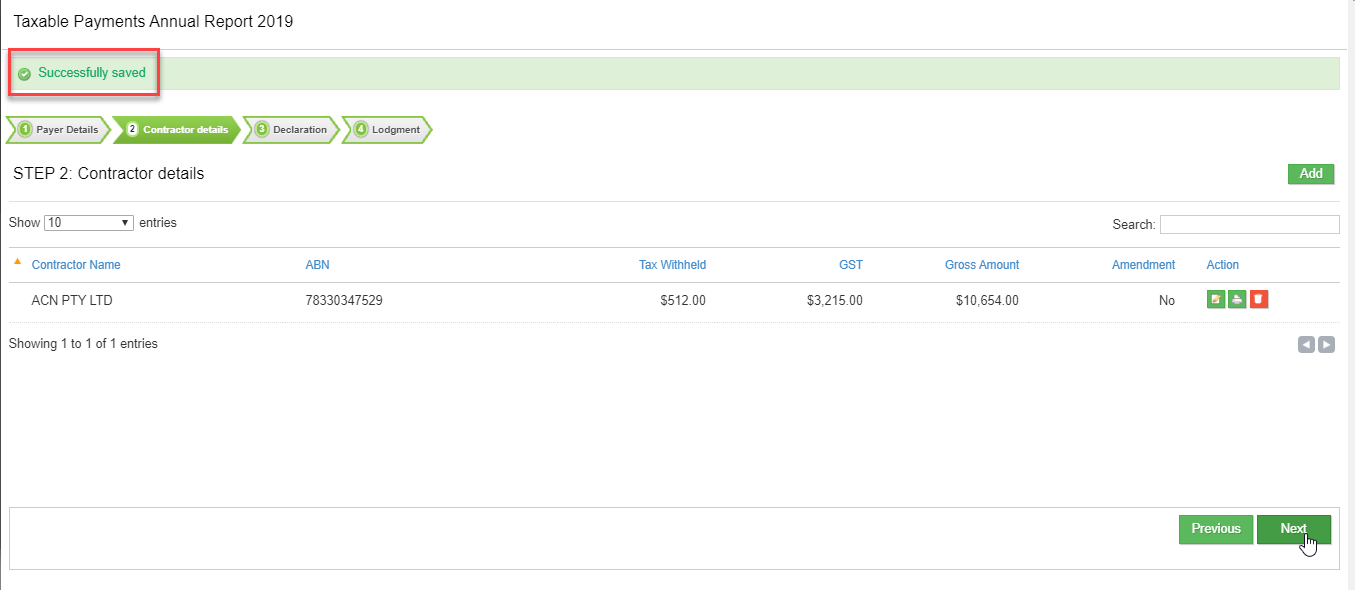

Step 8: View the ‘Successfully saved’message and click Next.

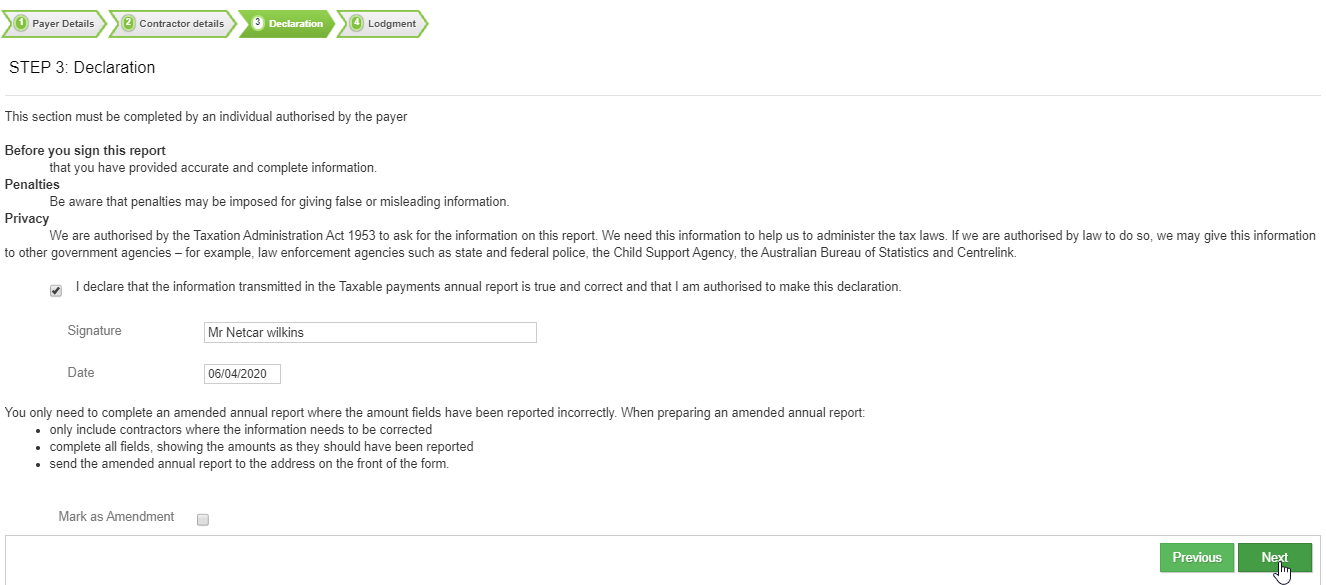

Step 9: Ensure by clicking the box and select Next.

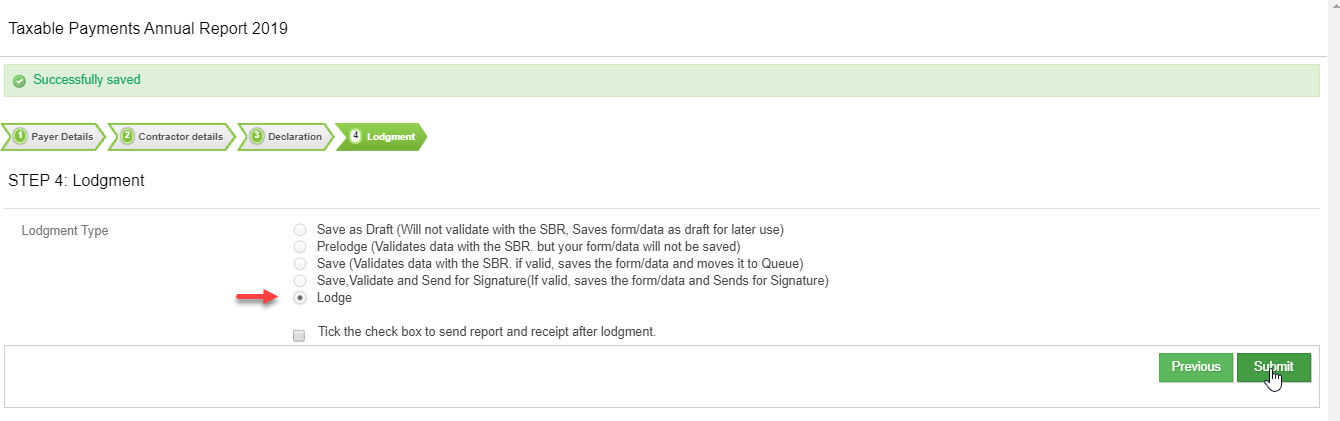

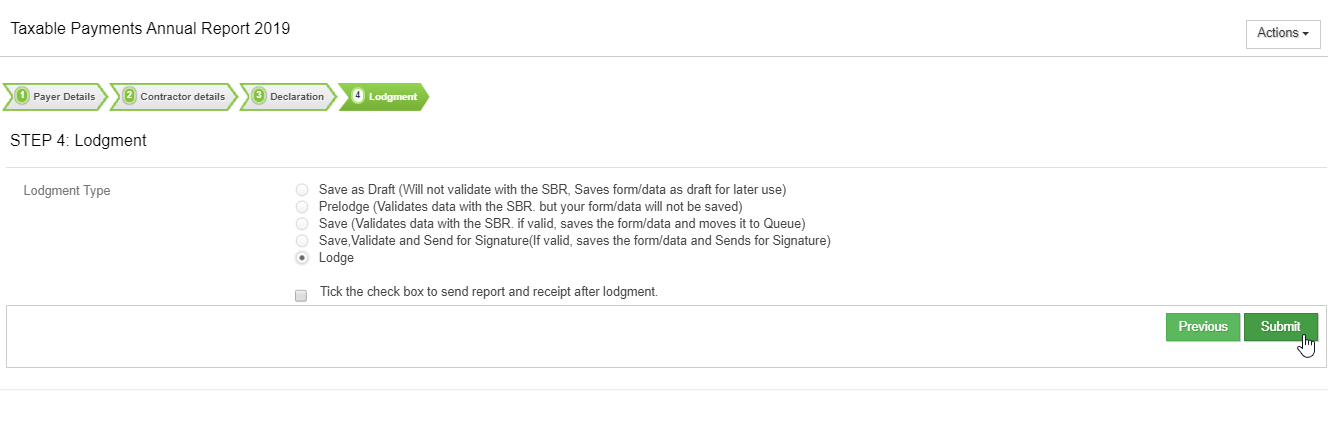

Step 10: Select the Lodge option and click Submit.

ii) Prelodge (when selected validates data with the SBR, but your form/data will not be saved).

iii)Save (when selected validates data with the SBR if valid, saves the form/data and moves it to queue).

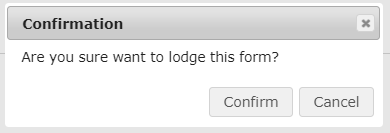

Step 12: Click Confirm to lodge TPAR.

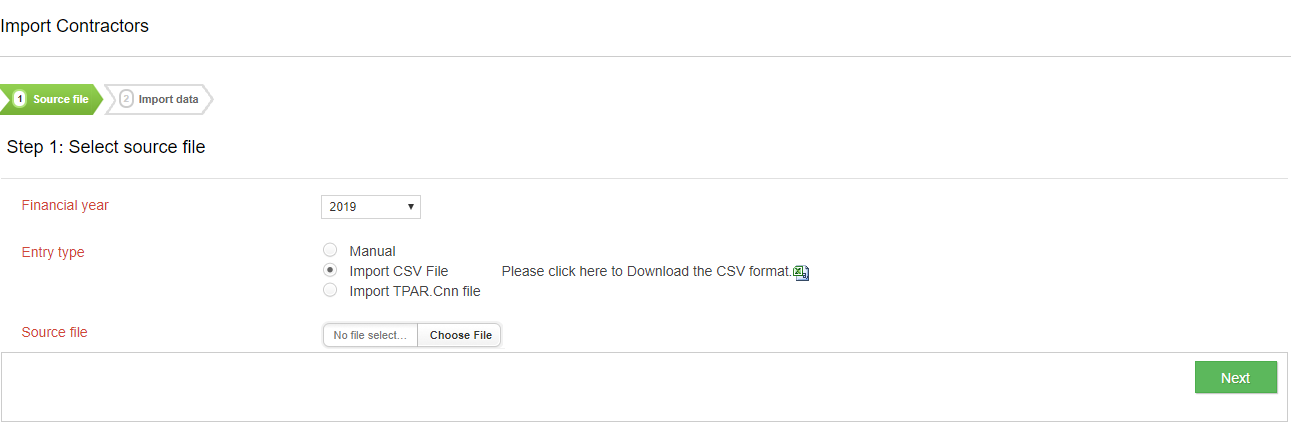

If you want to select your entry type as ‘Import’, you can follow the steps below:

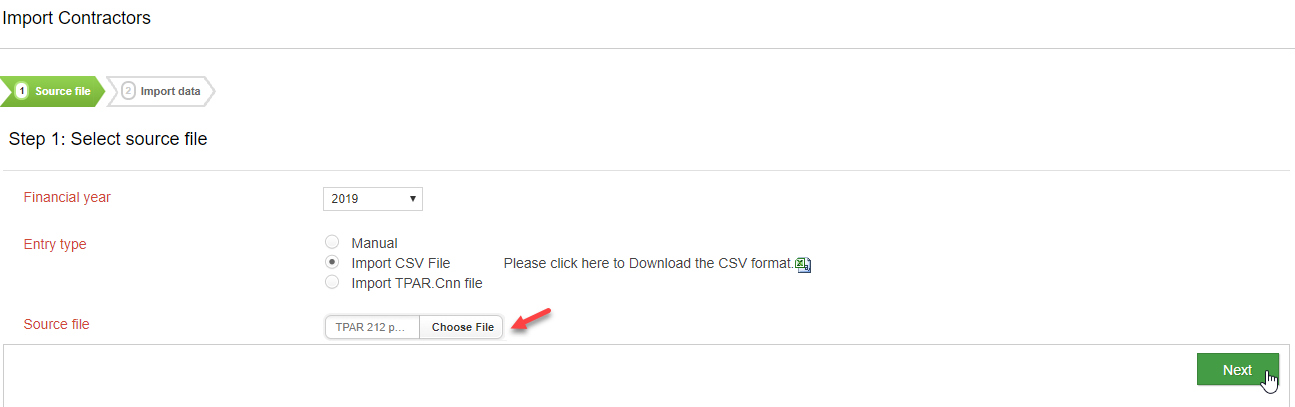

1.Select Entry type as ‘Import CSV file’

2.Choose File to upload

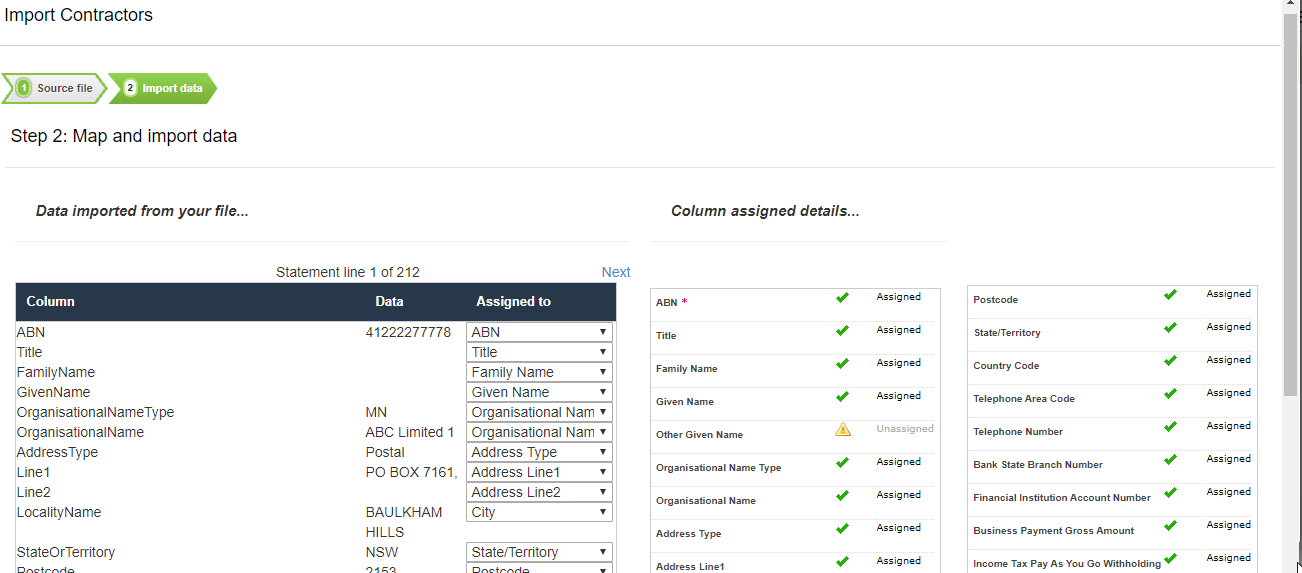

3.Import details will be automatically assigned based on the header name

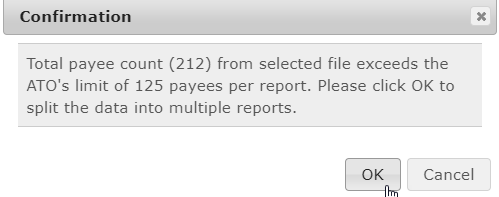

4.The confirmation screen appears where if the number of contractors is more than 125, it will be split into multiple reports of 125 contractors each. Click OK.

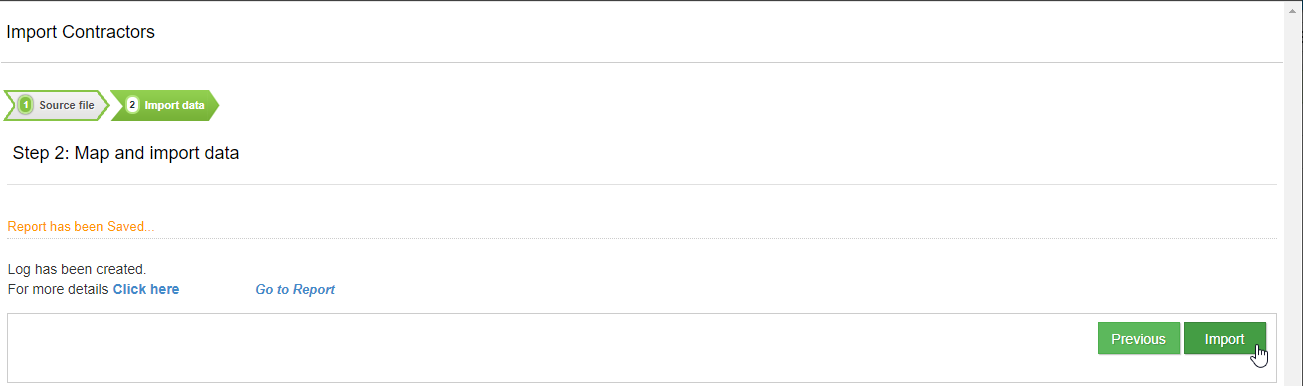

5.The report will be saved. Click on ‘Import’

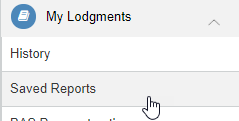

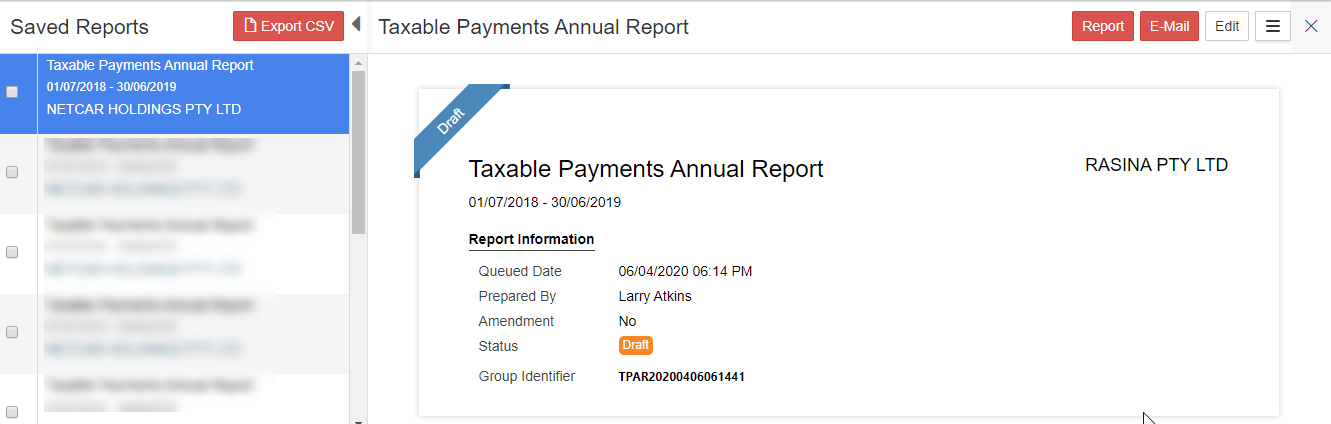

6.Go to My Lodgments -> Saved Reports where the imported TPAR report is saved

7.Click Open on the report

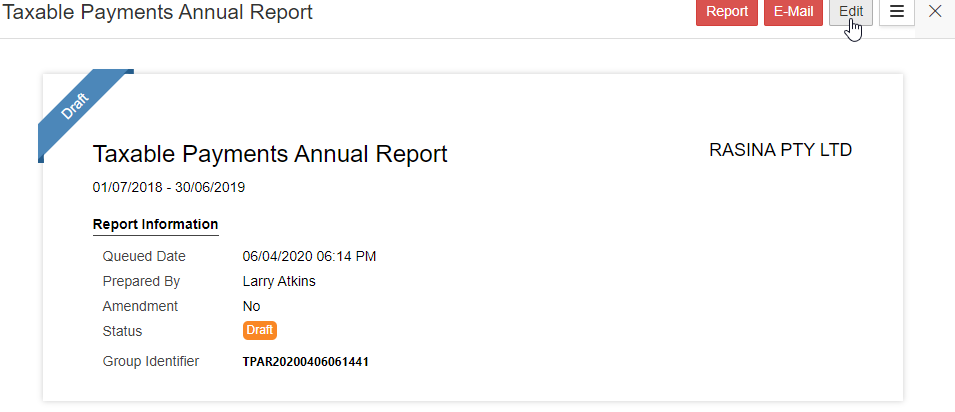

8.On the top right corner, click on ‘Edit’

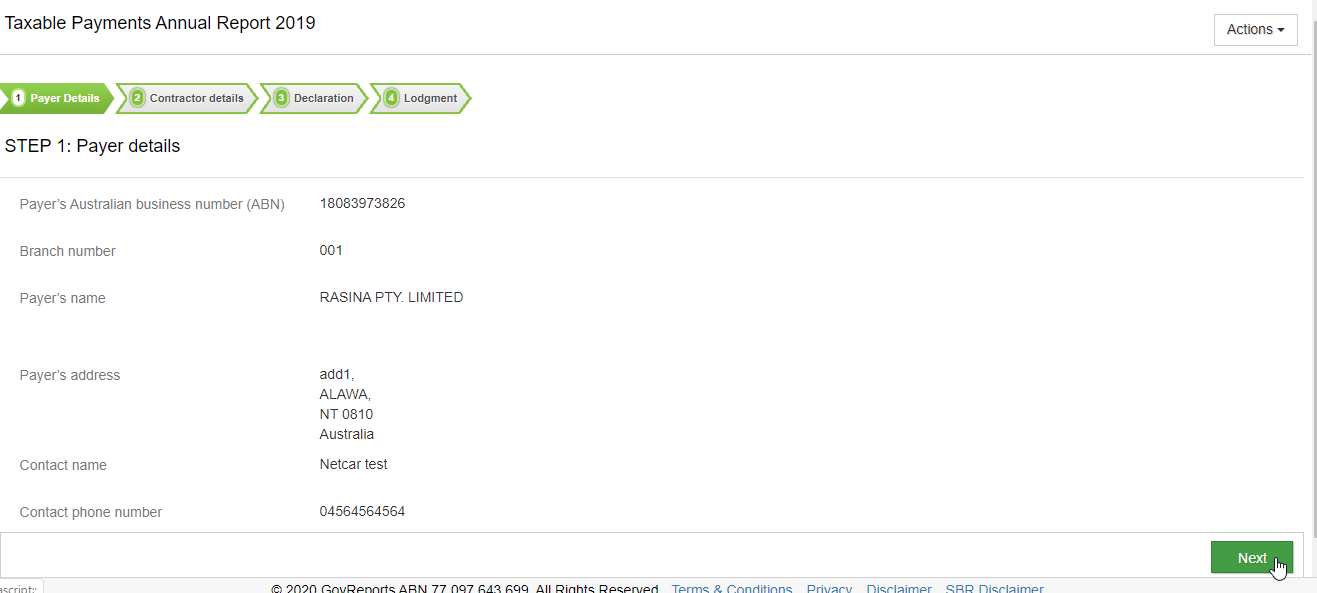

9.Click on ‘Next’

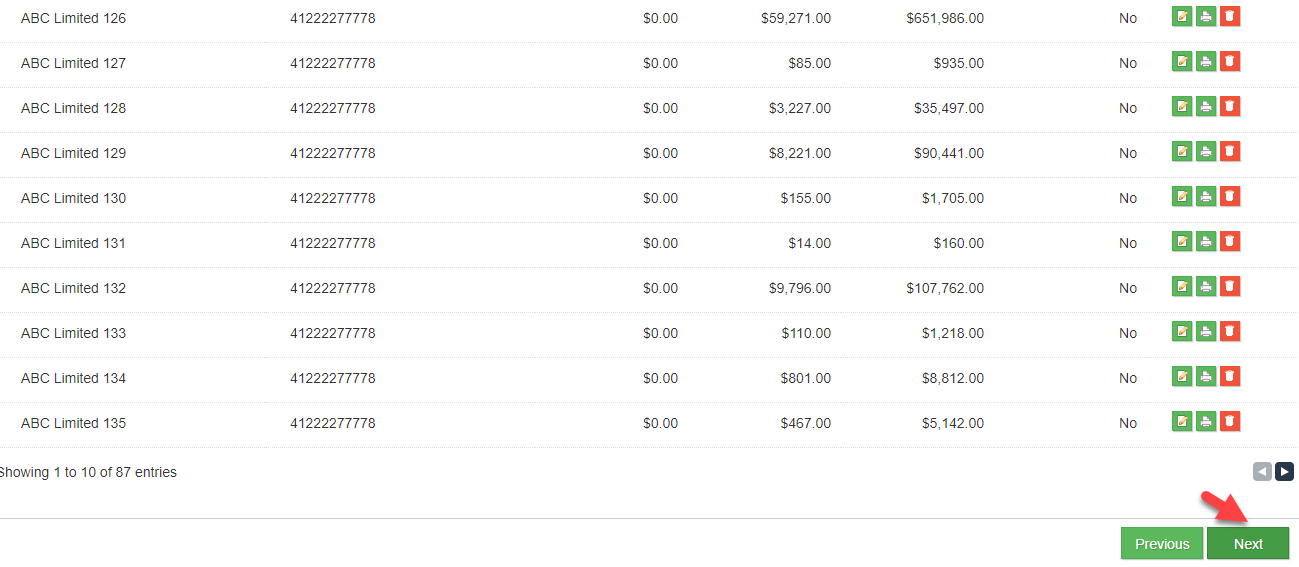

10.Review the contractor details and click on ‘Next’

10.Review the contractor details and click on ‘Next’

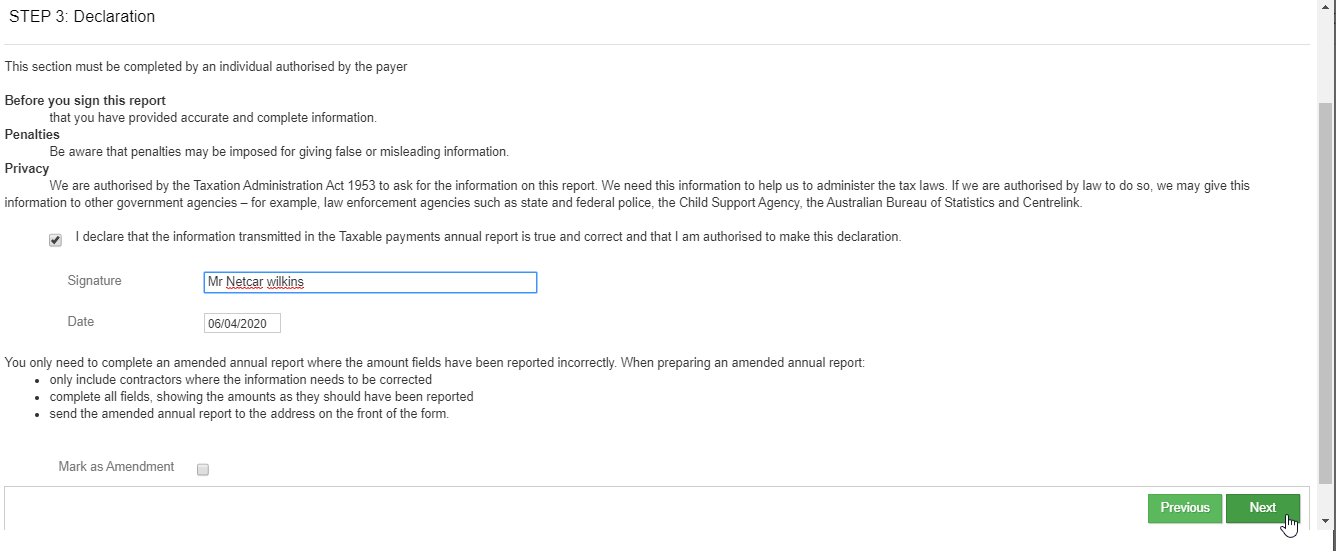

11.Tick the declaration and click on ‘Next’

12.Click on Lodge and submit

12.Click on Lodge and submit

13.Confirm the lodgment

13.Confirm the lodgment